In today’s competitive business environment, having the right business insurance is crucial. Whether you run a small startup or a large corporation, business insurance provides the protection needed to safeguard your enterprise against various risks. This article will guide you through the importance of business insurance, how to choose the right coverage for your needs, and how you can benefit from using BizCover to find the best insurance solutions. Plus, by using our exclusive link, you can enjoy an additional AUD 20 discount on each policy.

What is Business Insurance?

Business insurance is a type of coverage designed to protect businesses from potential financial losses caused by various risks, such as property damage, legal liabilities, and employee-related issues. Depending on the nature and size of the business, different types of business insurance can cover a range of potential issues, including:

- Property Insurance: Protects your business’s physical assets, such as buildings, equipment, and inventory, against risks like fire, theft, or natural disasters.

- Public Liability Insurance: Covers legal costs and compensation if your business activities cause harm or damage to a third party.

- Professional Indemnity Insurance: Provides protection against claims made by clients for professional advice or services that result in financial loss or damage.

- Cyber Insurance: Protects your business against internet-based risks and data breaches.

- Management Liability: Covers directors and officers of a company against claims arising from the decisions and actions taken within the scope of their regular duties.

GET IN TOUCH

Why is BizCover Business Insurance Important?

For any business, risks are inevitable. Without proper insurance coverage, your business could face significant financial losses that might even lead to its closure. Here are some reasons why business insurance is essential:

- Legal Requirements: In some industries or regions, certain types of insurance, such as workers’ compensation or public liability insurance, are legally required.

- Financial Protection: Business insurance helps your company survive unexpected incidents or disasters by covering the financial losses, ensuring that you can continue to operate.

- Client Confidence: A well-insured business is often seen as more reliable and professional, which can help build trust with clients and customers.

GET IN TOUCH

How to Choose the Right Business Insurance via BizCover?

Choosing the right business insurance can be challenging, as it requires careful consideration of multiple factors to ensure adequate coverage for the risks your business faces. Here are some key factors to consider:

- Business Size and Nature: The size and nature of your business will determine the types and levels of coverage you need. Small businesses might need only basic coverage, while larger enterprises might require more comprehensive policies.

- Industry Risks: Different industries have different risks. For example, construction companies may need higher public liability coverage, while retail businesses might prioritize property insurance.

- Budget: While comprehensive insurance coverage offers more protection, it’s important to choose a policy that fits within your budget without compromising essential coverage.

GET IN TOUCH

Available and Unavailable BizCover Policies by Occupation

BizCover caters to a wide range of industries and occupations, offering tailored insurance policies to meet the unique needs of each business type. Here’s a look at what’s available and what’s not for common occupations:

- Professionals (705 Occupations)

- Available Covers:

- Professional Indemnity

- Public Liability

- Business Insurance

- Cyber Insurance

- Management Liability

- Tax Audit

- Not Available:

- Workers Compensation

- Vehicle Insurance

- Available Covers:

- Trades & Services (909 Occupations)

- Available Covers:

- Public Liability

- Business Insurance / Tools

- Personal Accident & Illness

- Not Available:

- Workers Compensation

- Vehicle Insurance

- Available Covers:

- Retail (539 Occupations)

- Available Covers:

- Public Liability

- Business Insurance

- Cyber Insurance

- Management Liability

- Tax Audit

- Personal Accident & Illness

- Not Available:

- Workers Compensation

- Vehicle Insurance

- Available Covers:

- Manufacturing, Agriculture & Other (3,809 Occupations)

- Available Covers:

- Professional Indemnity

- Public Liability

- Business Insurance

- Cyber Insurance

- Management Liability

- Tax Audit

- Personal Accident & Illness

- Not Available:

- Workers Compensation

- Vehicle Insurance

- Available Covers:

These options ensure that businesses across different sectors can find the right coverage for their specific needs, while being aware of what’s not covered.

GET IN TOUCH

Why Choose BizCover?

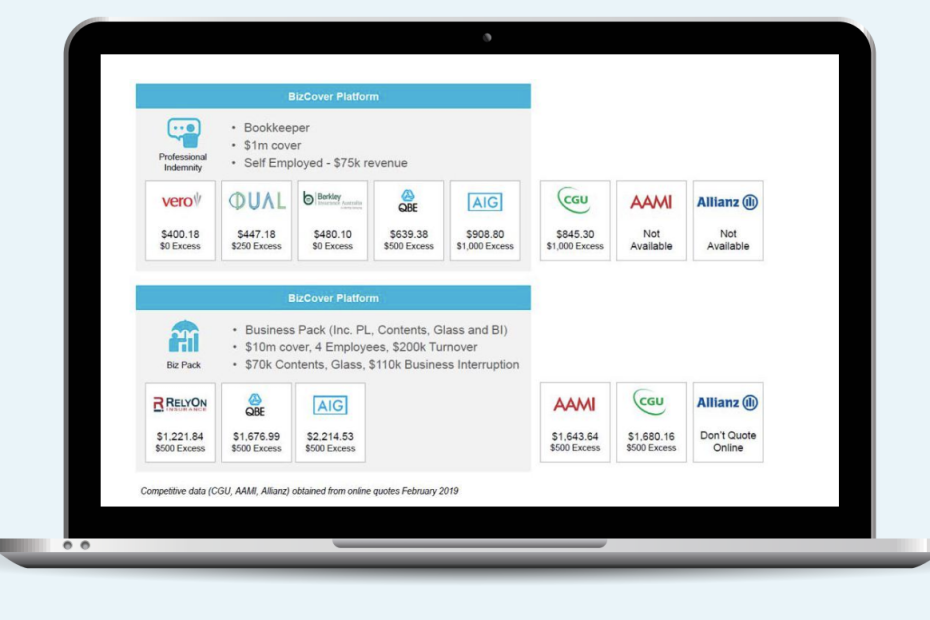

BizCover is a leading insurance comparison platform that offers business owners a quick and transparent way to compare insurance options. With BizCover, you can easily find the best insurance solutions tailored to your business needs. Additionally, BizCover provides competitive quotes and a simplified online application process, making it easy to secure the right coverage without the hassle.

- Quick Comparisons: Compare quotes from multiple insurance providers in just a few minutes.

- Transparent Pricing: No hidden fees—BizCover provides clear and upfront pricing information.

- Online Application: A streamlined application process allows you to obtain coverage quickly and efficiently.

[Click here] to compare different business insurance policies through BizCover and find the best coverage for your business. Plus, by using our exclusive link, you can enjoy an additional AUD 20 discount on each policy.

GET IN TOUCH

Disclaimer

We do not sell insurance; we are merely partners and cannot offer professional advice. Please contact BizCover directly for more information. We are mortgage brokers, so if you need a business loan or home loan, feel free to contact us.

Conclusion

Choosing the right business insurance not only helps you maintain financial stability in the face of risks but also boosts client trust and ensures the long-term success of your enterprise. With BizCover, you can quickly find the most suitable insurance policies to protect your business. If you’re looking for an easy and effective way to secure business insurance, click our referral link and start your comparison journey today.

Take Action Now! [Click here] to get a free business insurance quote and enjoy an additional AUD 20 off each policy through BizCover.

GET IN TOUCH